Version Info

| Version | Date | Content | Editor |

|---|---|---|---|

| 2.0 | 09/26/2016 | Create | Khuc Chi Huan |

Overview

Introduction

This document describes the payment integration between VTC Pay Gateway in the role of payment service provider and Merchant Shop (system of partner) in the role of sales organization, using online payment methods of VTC Pay via VTC Pay e-wallet and bank accounts (domestic and international internet banking).

This document describes functions which are necessary for integration, information transmission between two parties’ systems.

This document describes database stream that interacts between two systems in transaction process.

Definition of data exchange standards, safety solutions as well as authenticating transaction source.

Alpha Test Parameters

VTC Pay web address to register website integration, check transaction history :

http://alpha1.vtcpay.vn/wallet

Url sending order payment information :

http://alpha1.vtcpay.vn/portalgateway/checkout.html

Test Account:

Merchant test account to login VTC Pay to register website integration, check transaction history :

Account: 0963465816

Password: Aa@123456Customer’s VTC Pay e-wallet account to test order payment :

Account: 0357758300

Password: Abcd1234Customer’s Visa Card test order payment by international card :

Card Number: 4111111111111111

Zip/Postal Code: 123

CardType: Visa

CVN: 123

Exprition Date: 01/2020

Other fields: whatever in correct formatGolive Parameters

Website VTC Pay:

Url sending order payment information:

https://vtcpay.vn/bank-gateway/checkout.html

Note: Test and Golive Parameters are different, therefore, in this mode, Merchant need a valid VTC Pay e-wallet account:

- To register website integration.

- To receive money after successful transactions.

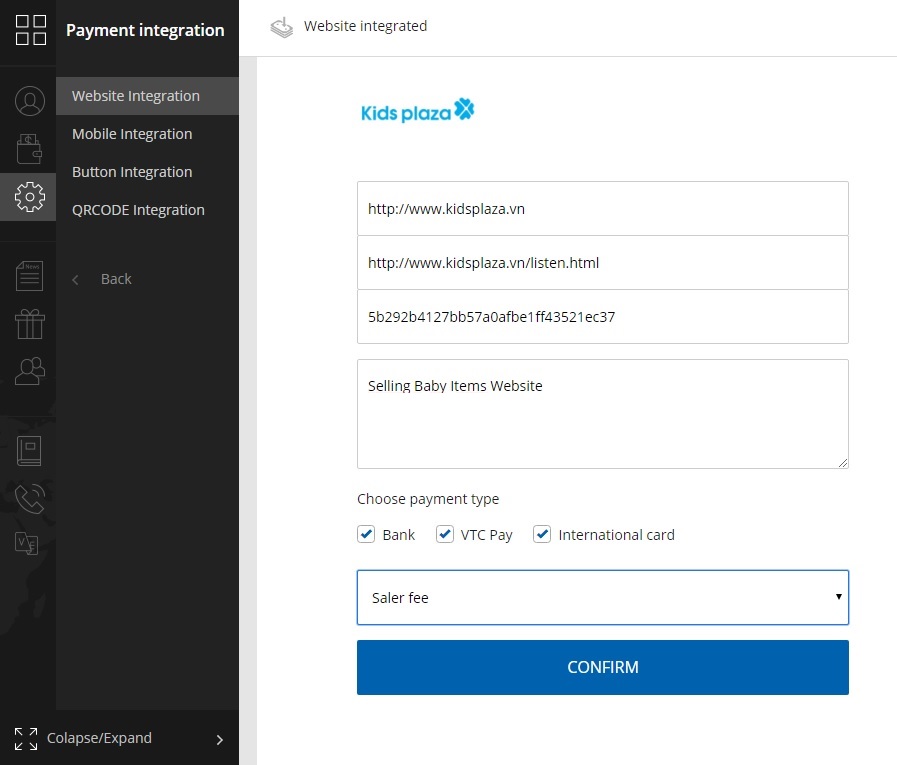

Website Integration Registration Tutorials

To register payment integration via VTC Pay, Merchant need to login VTC Pay e-wallet account, access to menu "Payment integration – Website Integration” to register an integration website. VTC Pay will show the interface that manages Merchant’s integration websites. Fill in necessary information and follow the instruction to complete integration registration.

Ex:

Note:

- Url Receiving: the address that receives order payment transaction result from VTC Pay according to POST. As in the example, it should be http://www.kidsplaza.vn/listen.html

- If Url Redirect is not on order, VTC shall redirect customers to Url Receiving.

- Website Secret Key: As information added when creating signature by SHA256 . Secret Key must include numbers, uppercase letter, lowercase letter, and have at least 16 characters.

- Transaction Fees: Merchants choose either buyers or sellers to be charged. Ex: A $100 oder with fee of $3, in case :

- Sellers be charged: Buyers spend $100, Sellers get $(100-3).

- Buyers be charged: Buyers spend $(100+3), Sellers get $100.

Programming Payment Integration

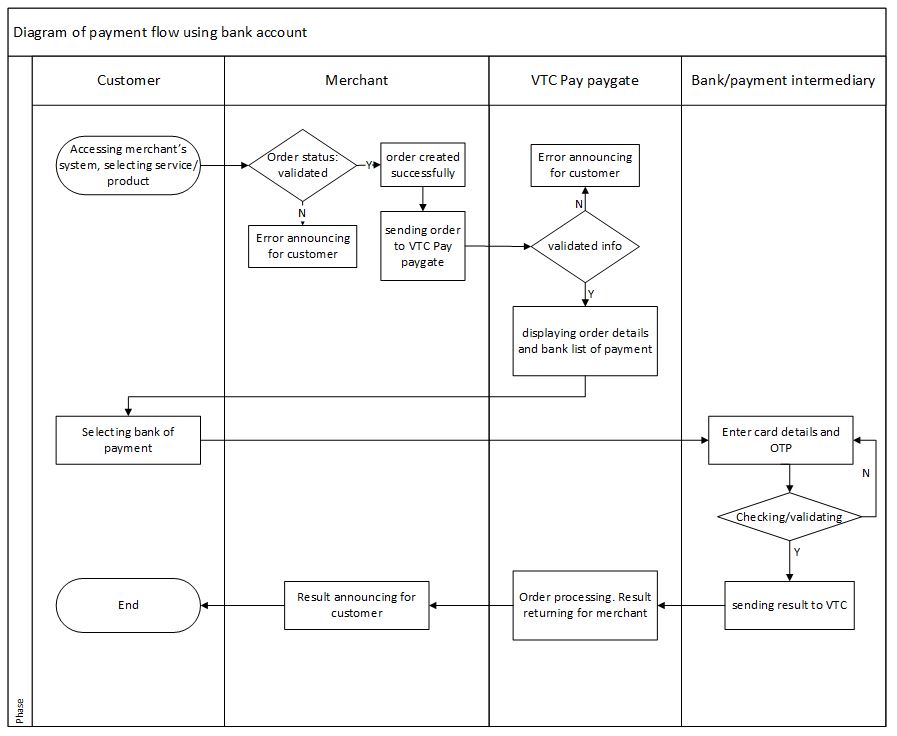

Payment Diagram using bank account :

Merchant request Parameters

| Field | Style | Compulsion (Yes/No) | Description |

|---|---|---|---|

amount | double | Y | Total amount of payment: - VND: rounded to 1 - USD: take 2 numbers after the comma |

bill_to_address | String(100) | N | Address of customer (number, street, etc.) |

bill_to_address_city | String(100) | N | City |

bill_to_email | String(100) | N | Email of customer |

bill_to_forename | String(50) | N | Name (Ex: Hung) |

bill_to_phone | String(30) | N | Phone number of customer |

bill_to_surname | String(50) | N | Surname/Family name (Ex: Nguyen Van) |

currency | string(5) | Y | Payment currency: - VND - USD |

language | string | N | Language displayed on VTC site. If not transmitted, Vietnamese is default vi: Viet Nam en: English |

payment_type | string | N | Payment type. Transmitting the following: - VTC Pay: payment by VTC Pay balance - Linkedcard: Pay by bank card link with VTC Pay wallet - DomesticBank: payment with only domestic bank - InternationalCard: payment with only international card In case of payment with specific bank, transmitting Bank code value is listed as appendix |

receiver_account | string | Y | Receiving account of customers after successful transaction |

reference_number | string(30) | Y | Ref. number of integrating partner. This number is unique and is the base of reconciling and monitoring |

transaction_type | string | N | Default value is: sale |

url_return | string | N | Merchant’s Url that VTC shall redirect customers after finishing transaction. If not transmitted, Url when registering to create website |

website_id | int | Y | Website ID code which is created by partner on VTC system |

settlement_ccy | string(3) | N | This is the currency that the partner will receive when transferring, only for some special partners |

signature | string | Y | Signature (SHA-256, Uppercase). Text to create a signature includes the value of parameters (plaintext, non-encode) and SecretKey. In the order of alphabet and divide with “|” |

Note: The value of the url request parameter requires encode (urlencode)

(*). Compulsory Fields :

Y: Must transmit to url

N: Maybe null, empty or no need.

Signature: This is an example with full parameters in the following order:

amount|bill_to_address|bill_to_address_city|bill_to_email|bill_to_forename|bill_to_phone|bill_to_surname|currency|language|payment_type|receiver_account|reference_number|transaction_type|url_return|website_id|settlement_ccy|SecurityCode

SecurityCode: Passcode created in Website Integration Registration Process

In case of missing some parameters (ex: bill_to_address_city, transaction_type, url_return), text to generate signature should be like that :

amount|bill_to_address|bill_to_email|bill_to_forename|bill_to_phone|bill_to_surname|currency|language|payment_type|receiver_account|reference_number|website_id|settlement_ccy|SecurityCode

Returned result according to POST (server to server)

HTTP POST is the connection form of Server to Server. Data will be posted from VTC Pay server to receiving site at Merchant server that’s the site when creating website integration. VTC always posts transaction result to this receiving site. Processing result posted by VTC is optional. However, Merchant should analyze the result posted by VTC because:

⇒ It helps Merchant receive the result all time, avoid not receiving the result if using HTTP Get, in case customers turn off their browser in transaction process or problems of the internet connection.

⇒ It helps Merchant receive the final result, special with verified transactions that need to be approved by VTC admin.

Parameters of order payment result that VTC Pay return to Merchant’s site:

| Field | Style | Compulsion (Yes/No) | Description |

|---|---|---|---|

data |

string |

Y | amount|message|payment_type|reference_number| status|trans_ref_no|website_id |

signature |

string |

Y |

Encrypt SHA256 (UTF8 Encoding) fields based on the following format: amount|message|payment_type|reference_number|

status|trans_ref_no|website_id|secret_key secret_key: secret key you entered when creating website |

Note: When receiving the result returned, Merchant has to check amount of money returned and amount of money sent to VTC Pay is correct or not. If it is not correct, the result returned is invalid, need to contact with VTC to check again.

Returned result according to HTTP GET

After finishing checkout process, VTC Pay shall redirect customer to receving site of Merchant, and return the payment result to Merchant at the same time through parameters on Url.

Details of returned parameters:

| Field | Style | Compulsion (Yes/No) |

Description |

|---|---|---|---|

amount |

int |

Y | Value of order, is the amount money of order in Merchant’s system |

message |

string |

N | Additional information |

payment_type |

string |

N | Payment form that customer process transaction |

reference_number |

string(50) |

Y | Order ref. that Merchant send |

status |

int |

Y | As in Appendix |

trans_ref_no |

|

VTC ref. code | |

website_id |

int |

Y | Website’s code registered on VTC Pay, in Website integrating managing session on VTC Pay |

signature |

string |

Y |

Encrypt SHA256 (UTF8 Encoding) fileds in the order of alphabet, and add secret_key in the end. Respectively:

Amount|message|paymentType|reference_number|

status|trans_ref_no|website_id|secret_key secret_key: secret key you entered when creating website |

Appendix

Appendix of order payment

| Status | Mean | Note |

|---|---|---|

0 |

|

Transaction status of initializing |

1 |

SUCCESS |

Successful transaction |

7 |

REVIEW |

Payment account of customer is deducted but Merchant’s account is not credited. Payment admin department of VTC will approve to decide transaction is successful or failed. |

-1 |

FAIL |

Failed transaction |

-9 |

FAIL |

Customer cancel transaction |

-3 |

FAIL |

VTC admin cancel transaction |

-4 |

FAIL |

Account not eligible for transaction (Locked, not registered for online payment ...) |

-5 |

FAIL |

Customer account balance (VTC Pay ewallet, bank account) is not sufficient to make payment |

-6 |

FAIL |

Transaction error at VTC |

-7 |

FAIL |

Customer enter wrong payment information (account information or OTP) |

-8 |

FAIL |

Exceed day transaction limit |

-22 |

FAIL |

Order payment value is too small |

-24 |

FAIL |

Order payment currency is not valid |

-25 |

FAIL |

Merchant’s VTC Pay receiving account does not exist |

-28 |

FAIL |

Lack of compulsory parameters in one online payment order |

-29 |

FAIL |

Request parameter is not valid |

-21 |

CHECK |

Duplicating transaction reference. May be because of duplicating solving is not good, poor internet connection, customer enter F5, or poor transaction code generating, partner must check to get the final result of this transaction |

-23 |

CHECK |

WebsiteID does not exist |

-99 |

CHECK |

Undefined errors and transaction status. Must check to know if transaction is successful or not |

Appendix of banks list

| Bank code | Bank name |

|---|---|

Vietcombank |

JSC Bank for Foreign Trade of Vietnam - Vietcombank |

Techcombank |

Vietnam Technological and Commercial Joint- stock Bank - Techcombank |

MB |

Military Commercial Joint Stock Bank - MBBank |

Vietinbank |

Vietnam Joint Stock Commercial Bank for Industry and Trade - Vietinbank |

Agribank |

Vietnam Bank for Agriculture and Rural Development - Agribank |

DongABank |

DongA Joint Stock Commercial Bank - DongABank |

Oceanbank |

Ocean Commercial One Member Limited Liability Bank - Oceanbank |

BIDV |

Bank for Investment and Development of Vietnam - BIDV |

SHB |

Saigon – Hanoi Commercial Joint Stock Bank - SHB |

VIB |

Vietnam International Commercial Joint Stock Bank - VIB |

MaritimeBank |

Vietnam Maritime Commercial Joint Stock Bank - MaritimeBank |

Eximbank |

Vietnam Export Import Commercial Joint Stock Bank - Eximbank |

Master |

Master |

Visa |

Visa |

Jcb |

Jcb |

ACB |

Asia Commercial Joint Stock Bank - ACB |

HDBank |

Ho Chi Minh City Development Joint Stock Commercial Bank - HDBank |

NamABank |

Nam A Commercial Joint Stock Bank - NamABank |

SaigonBank |

Saigon Bank for Industry and Trade - SaigonBank |

Sacombank |

Saigon Thuong Tin Commercial Joint Stock Bank - Sacombank |

VietABank |

VietNam Asia Commercial Joint Stock Bank - VietABank |

VPBank |

Vietnam Prosperity Joint-Stock Commercial Bank - VPBank |

TienPhongBank |

Tien Phong Commercial Joint Stock Bank - TienPhongBank |

SeABank |

Southeast Asia Commercial Joint Stock Bank - SeABank |

PGBank |

Petrolimex Group Commercial Joint Stock Bank - PGBank |

NCB |

National Citizen Bank - NCB |

GPBank |

Global Petro Commercial Joint Stock Bank - GPBank |

BACABANK |

Bac A Commercial Joint Stock Bank - BacABank |

OCB |

Orient Commercial Joint Stock Bank - OCB |

LienVietPostBank |

Lien Viet Post Joint Stock Commercial Bank - LienVietPostBank |

ABBANK |

An Binh Commercial Join Stock Bank - ABBank |

PVcomBank |

Vietnam Public Joint Stock Commercial Bank - PVcomBank |

BVB |

Bao Viet Joint Stock Commercial Bank - BaoVietBank |

SCBBank |

Sai Gon Joint Stock Commercial Bank - SCB |

KienLongBank |

Kien Long Commercial Joint Stock Bank - Kienlongbank |

VRB |

Vietnam - Russia Joint Venture Bank - VRB |

PublicBank |

Public Bank |